Last Updated on June 8, 2020

Welcome to article #5 of the 14 part series on influencer marketing. So far we have discussed:

- What is influencer marketing?

- Why should it be a part of your strategy?

- How can you set campaign goals for it?

- Who should you try to influence?

The next logical step in the process is to discuss channel selection and provide some case studies as examples. Knowing who you’re targeting and what your goals are, it is now important to understand where to focus, based on your specific needs. Not all social channels are created equal and not all will be effective for all types of businesses, so let’s dive in.

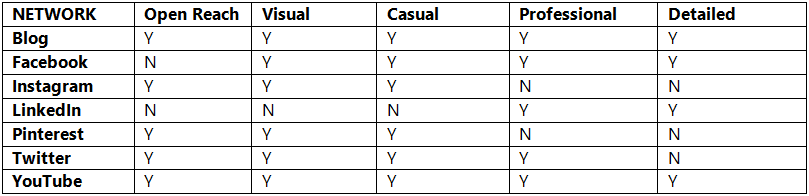

Intellifluence Social Channel Usefulness Matrix

The following channels are currently available for matching influencers and brands at Intellifluence; for the purposes of this post we excluded Amazon since it is a special case. This is not meant to be a comprehensive list of every social network’s usefulness, largely because it becomes a slippery slope of inclusion and what might be a 2,000 word post would become 20,000 trying to include all the various clones and limited audience networks that exist.

For simple definitions, the columns represent a surface ‘yes’ or ‘no’ on the following questions:

- Open Reach — Is the reach of the post open for most anyone to view it? In the case of blogs, tweets, pins, and YouTube videos that is usually a ‘yes’. It is possible to have private channels, but they are rarer; Instagram does have a higher incidence of private accounts than Pinterest, but the majority are still open. Facebook and LinkedIn are the notable exclusions — fan pages on Facebook are open, but most Facebook posts are set to the ‘friends’ setting, which limits the audience exposure; similarly unless you are explicitly following or otherwise connected to an individual on LinkedIn you won’t see the posts.

- Visual — Is the network capable of supporting visual content? More than just technical capable, which all are, does the audience accept and request visual content? In the past couple of years, Twitter moved into the ‘yes’ category, with the lone holdout being LinkedIn — it is possible to share visual content on LinkedIn, but it generally does not fit with expectations… Most LinkedIn users complain of the Facebookification of the connection feed with non-business posts.

- Casual — Is it acceptable to post casual information? Blogs are a somewhat special case since each publication is sure to be different in editorial policy, but presumably so long as an influencer is interested in reviewing a product, a casual tone would not be an issue. Once again, the holdout is LinkedIn, where a casual tone runs counter to professional decorum.

- Professional — Finally, a signal that strongly benefits LinkedIn. Technically, professional tone may not be accepted on certain blog channels as the inverse of the casual discussion in the previous post, and some Twitter and Facebook channels might not be the right place for an appropriate discussion, but that is tone specific. For the most part, the only two channels in our experience that tend to not skew professional are Instagram and Pinterest, which has more to do with the extreme visual nature of the platforms than anything else.

- Detailed — Is it possible to provide a comprehensive review of a product or service? Yes, it is possible to provide a brief blurb of a blog post and link to it from Twitter or from a Pinterest pin, but for the purposes of self-contained posts, this is meant to be used as a filter when a lot of information needs to be conveyed in a single setting.

Understanding our take on the various social networks we work with at Intellifluence, let’s put this selection into practice with some mini case studies on campaign building that you can use as examples after you sign up and want to start selling more over social.

B2B Enterprise Buyers

Created for: Timi Garai

Company: Antavo

Before we can determine which channels to target, it is important to build a buyer persona. As a quick and dirty way of doing this, I pulled up the Antavo Loyalty twitter account and started dissecting its followers. Note that Antavo bills itself as loyalty marketing software for eCommerce companies to build reward programs, so I decided to find followers that fit the criteria. Interestingly, while I fully expected to find a plethora of eCom companies, what I found more interesting is the number of eCom consultants. Perfect.

Sample buyer persona:

Title: Owner/analyst

Industry: eCommerce, consulting

College educated

Age/gender neutral

Influenced by data

What could Antavo do with this data? Could it build a campaign that works? Their product is complex with a long sales process and caters to professionals.

Step 1: Find those peers

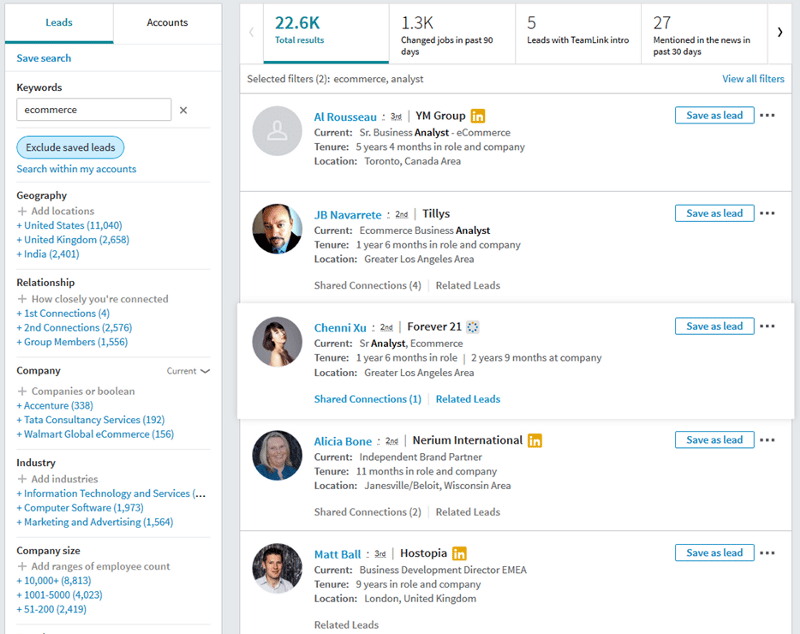

Thankfully, this is going to be very easy for Antavo. Pulling up LinkedIn Sales Navigator, I plugged in some ecom and analyst filters to see that with some effort, 20,000+ individuals could be targeted.

Step 2: What do these peers want?

Prestige and value. One significant value add that I can see for this process would be to build out a multi-channel campaign that plays to the egos of the buyer persona, and then use that to attract more peers.

Step 3: Channels that work

For the purposes of this sample, I would use blogs, LinkedIn, and Twitter, in the following way…

1. Outreach to provide a discount on the Antavo service for those that sign up via the chosen sample reviewer (ecom consultant), in exchange for a comprehensive blog post on the reviewer’s blog.

2. Reviewer shares blog post on LinkedIn.

3. Reviewer then tweets a link to the review post.

4. Antavo conducts an interview with the review for the Antavo blog.

5. Process repeats for 10 reviewers.

6. Antavo takes the 10 interviews generated and creates an ebook download on “10 out of 10 eCom consultants can’t be wrong” which is made available for the price of an email address.

7. Antavo re-engages the 10 reviewers to share the ebook on LinkedIn, Twitter, and their personal blogs.

8. Antavo taps into Twitter ad platform to target lookalike audiences of reviewer list (or to the LinkedIn Sales Navigator broader email list).

9. Antavo sales team aggressively targets the rest of the list via LinkedIn, sending the ebook out for social proof.

Such campaigns are not easy, but having spent the majority of my career in digital B2B, I can attest to the process yielding dividends.

B2B Smaller / Mid-sized Business

Created for: Matthew Barby

Company: HubSpot

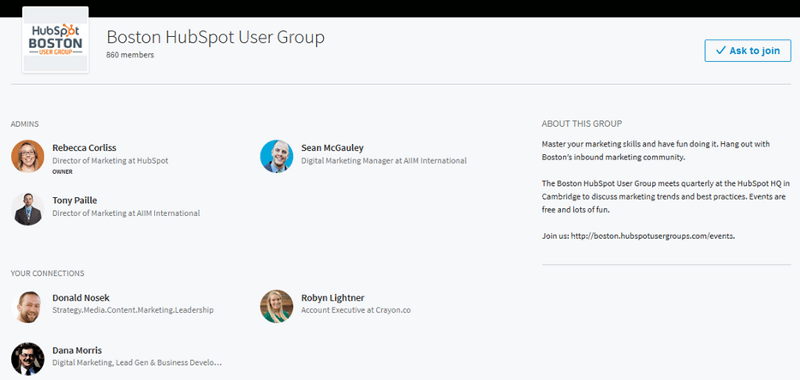

HubSpot makes for an interesting case because they have so many different products all throughout the small/medium sized business market. In some ways this makes life more difficult because one needs to focus on a specific buyer persona when building out the campaign idea. Looking at the HubSpot Twitter account, it is too noisy — some are fans, some are following to learn, some are industry players. It is still doable, but to show another way to do this, we can look into area user groups on LinkedIn.

Peeking behind the group curtain we find a large number of “inbound marketing” titles, many of which are mid-career (manager through director) but once again, the prevalent buyer persona being built by sorting through the list is not that of end-users, but instead of consultants. If we were to go through this channel, the channel selection would end up being similar to that of Antavo, so we’re going to pick a secondary buyer persona, one of end users for the inbound sales platform.

Sample buyer persona:

Title: E-commerce manager

Industry: Open

Company size: 11–50

Negatives: HubSpot

Step 1: Find those peers

According to LinkedIn Sales Navigator, this is an even more impressive list, and one I currently have saved for future sales purposes. Nearly 66,000 individuals that don’t mention HubSpot that are possible buyers.

Step 2: What do the peers want?

While prestige and ego bait are nearly universal in practice, to provide an alternative angle of approach we can take the strict review path and offer an incentive by providing compensated Pro accounts.

Step 3: Channels that work

Similar to B2B Enterprise, we are looking at blog, LinkedIn, and Twitter as the primary channels. For a wrinkle, I’ll throw in YouTube.

- Outreach to a large number of the e-commerce managers (~100) to provide compensated Pro accounts, with the option at the end of a 30 day evaluation period to write a blog post on the site in which the Pro account is used OR to do a recorded Hangout / Skype interview to be posted on the ecom site’s YouTube channel.

- Reviewer shares blog post or video link on LinkedIn.

- Reviewer tweets link to the review URL.

- HubSpot systematically shares a highlighted review/day on their LinkedIn account.

- HubSpot sources video reviews with intro on their YouTube channel.

- HubSpot amplifies all tweets to reviewer audience + lookalike audience.

- HubSpot amplifies LinkedIn shares to their Showcase page through sponsored content ads.

- Reviews are added to drip campaign on existing flow for HubSpot trial accounts.

- State of eCommerce sales whitepaper created by HubSpot, aggregating data from the ~100 users to show how quickly results can be had for using their sales platform.

- Whitepaper is used provided at top-of-funnel for a secondary drip campaign.

The difficulty in building out a campaign for HubSpot is they already eat and breathe this type of campaign. Given they have such a large organization and can focus, I think it’d be interesting to see how effective it would be to run such a campaign on a continual basis, choosing 100 e-com managers per month, resulting in a constant influx of links, honest reviews, and video assets which would be difficult for competitors to match in intensity.

B2C Mobile Apps

Created for: Brian Norgard

Company: Tinder

How can I do this case study without getting in trouble? For those of you not familiar with Tinder, the year is 2016 and it is heavily used casual dating app. What makes it an intriguing case study is that it is not often something one expects to see throughout social feeds. There are quite a few buyer personas one could create based on the data Brian likely has on usage, but for simplicity we’ll focus on areas where social proof is the most effective.

Sample buyer persona:

Gender: Male

Age: 18–30

Other: not currently a tinder boost user

Step 1: Find those peers

Since we’re no longer dealing with a professional focus, we can leave LinkedIn out of the equation; for fun we can use Instagram and look for snipe competitors at the same time by pulling followers of accounts like eHarmony.

Step 2: What do the peers want?

Do I have to really answer this question? The peers want butterflies, rainbows, and sunshine. Also, a date. In order to satisfy the primary demand, a month of ‘Boost’ for free would elicit the expected response.

Step 3: Channels that work

For our purposes, let’s stick with Instagram. I can conceive of how to make this work on Twitter and Facebook as well, but I think a visual story will say everything necessary.

- Outreach, sorting descending by follower count, to the male followers of the eharmony account (and others — this is just a quick example). In exchange, user needs to post a screenshot (anonymizing who is matched of course) with how quickly he received a positive response to date.

- Reviewer posts the screenshot on Instagram noting that he used Tinder Boost and had plans for the evening in X min.

Believe it or not, this is probably sufficient. As discussed in previous posts, the peer influence among other males ages 18–30 that see how quickly a potentially lonely evening was turned into a date is quite strong; the point is not so much to engage and interact on behalf of Tinder, but to allow the outcome of the product to speak for itself.

B2C Fashion

Created for: Dennis Goedegebuure

Company: Fanatics

We’ve spoken about Fanatics before in another post, referencing Yankees and Cubs, but this maker of all entertainment apparel could use with one more case study. They do have different buyer personas that skew towards either fashion choices or fan choices, but in this case, it is time for something special.

Sample buyer persona:

Gender: Male

Age: late 30s

First name: Joe

College: University of Arizona

Sport: Basketball

Step 1: Find those peers

There are numerous ways to find this peer group, but one easy way would be consume Twitter hashtag usage looking for super fans. Another great method would be to hunt on Facebook Groups for [college + sport] combinations and interacting with the various communities found therein.

Step 2: What do the peers want?

Swag. Respect. Prestige.

Step 3: Channels that work

Using humor for this campaign, let’s pick YouTube, Facebook, Twitter, and Instagram.

1. Outreach to a certain overweight guy in Arizona that loves UofA basketball.

2. Reviewer is sent a jersey.

3. Reviewer films a compilation video of various people dunking on him mercilessly, preferably using former UofA stars for additional celebrity influence.

4. Review posted to natively to each platform, edited down for Instagram stories.

5. Sports stars involved in the humor appropriately tagged.

6. Celebrities will most likely share on their own volition; Fanatics can share on their channels, continuing on with their impressive super fan series. On each share, tie-in buttons created to purchase specific apparel used directly from the Fanatics store.

Takeaway

No matter whether B2B or B2C, it is possible to include influence as part of the overall campaign and have it work; the biggest consideration needs to be consistency of channel usage that best fits the constraints of the chosen buyer persona.

Joe, CEO and Co-Founder of Intellifluence, has over 25 years of experience in SEO, leading several successful marketing companies and providing expert consultation. He is the author of The Ultimate Guide to Using Influencer Marketing, which is available as an eBook or in print.